How To Build Better Money Habits : Money Habit Top 101

Better Money Habits come with practice and are more than just being on the path to financial independence, it has more to do with the way you control money, rather than the amount you earn.

If you want to know more about how to build better money habits, you are at right place, I will help you with 10 step process and additional tips that will help you.

Why should you build better money management habits?

We live in times, where the threat of economic recession can be a crisis due to a large number of reasons.

Also you need to look at your spending habits if you do not keep track, you may get in to bad financial situation.

Developing the skill to manage time and money to your advantage saves you from future troubles, and helps you be on a path to better financial success (better money saving, more free time).

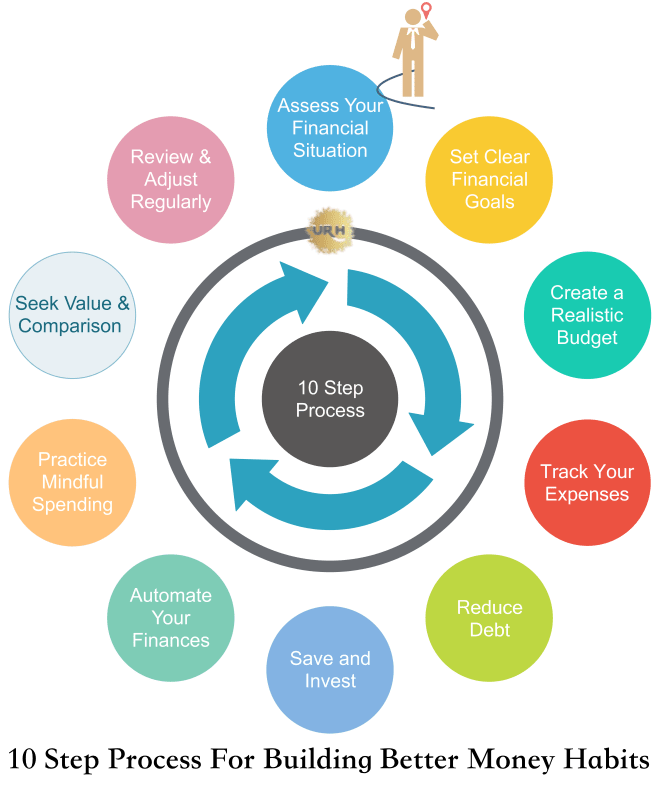

10 Step Process For Building Better Money Habits

Building better money habits requires a systematic approach and consistent effort making decisions about your money (earning, saving, and spending).

Here are the steps you can take toward developing healthier financial practices:

How To Build Better Money Habits – 10 Step Process

Step 1: Assess Your Current Financial Situation:

You can start by evaluating your current financial standing. List down all your income sources and monthly earning from them.

Now list down all expenses (monthly/yearly), debts, and savings, this assessment will help you understand your financial strengths and weaknesses.

This will also help you and identify areas where you can focus and improve your money management.

Step 2: Set Clear Financial Goals:

Once you have the assessment, define specific and achievable financial goals that align with your priorities.

Whether it’s saving for a down payment(Home/Car), paying off debt(Personal loan), or building an emergency fund, having clear goals provides focus and motivation for better money habits.

Step 3: Create a Realistic Budget:

It is very important to develop a budget that reflects your income (income from all sources), expenses (monthly and yearly), and financial goals.

So, start by allocating your income to cover essential expenses, debt repayment, savings, and some other small spending.

Make sure your budget is realistic and allows for flexibility (any emergency which needs additional money)while still keeping your financial priorities in focus.

Step 4: Track Your Expenses:

Do it every single day, monitor and track your expenses. Record all your purchases and then review this information periodically (twice a month).

Step 5: Reduce Debt:

Identify your high-interest debts first and put them on top of your list to repayment. Create a debt repayment plan (Monthly credit card payments, car/home loan payments) that outlines how much you can allocate towards paying off your debts each month.

Take advice on options like the debt snowball or debt avalanche method which can accelerate your progress.

Step 6: Save and Invest:

You can cultivate a habit of saving regularly. Set up automatic transfers from your income (salary account) to a separate bank account where you keep your savings.

Gradually increase the amount you transfer to your dedicated savings account.

Step 7: Automate Your Finances:

Take advantage of automation tools and services to streamline your financial management. This also saves you time.

Set up automatic bill payments through your bank portal, savings transfers (monthly SIP), and investment contributions.

Automating your finances helps ensure consistency as it does not require manual intervention and reduces the chances of late payments or missed opportunities to save.

Step 8: Practice Mindful Spending:

So before making a purchase, pause and evaluate whether it aligns with your values and financial goals. Consider whether it is a necessary expense or an impulsive purchase.

Develop the habit of differentiating between wants and needs, and focus on spending consciously and purposefully.

Step 9: Seek Value and Comparison Shop:

Do your price research, compare products or services, and look for discounts or deals before making a purchase.

Step 10: Review and Adjust Regularly:

Regularly review your progress, reassess your goals, and adjust your habits and strategies as needed.

Financial circumstances can change, and staying proactive allows you to stay on track and make necessary adjustments.

But what exactly are better money habits?

They are the routines and behaviours we adopt when it comes to earning (number of sources), spending, saving(regular saving), and investing money (financial instruments / real estate).

One of the early steps towards building better money habits is to create a budget and stick to to your budget.

A budget serves as a roadmap for your finances (your earning and expenses planning). This also help you allocate your portion of your income wisely to the needs you have and helping you to track your expenses against the plan.

Another important aspect of improving money habits is paying off debt (Car loans, Home loans).

You can do this by developing a plan to tackle your debts systematically, you regain control over your finances.

Save for retirement, while retirement may seem far off, starting early can make a significant difference in the long run.

Another important aspect of developing better money habits is avoiding impulse purchases, take time (24 Hrs.) before making any decision to purchase nonessential items.

Lastly, living below your means is a fundamental principle of building better money habits, it involves spending less than you earn and prioritising long term financial security over short term indulgences.

Better Money Management Tips

Tips for better money management habits that you can incorporate into your daily life:

Tip 1: Embrace Frugal Living:

Understand and differentiate between wants and needs before making a purchase, and consider what is really needed. Shop with a list, compare prices, and look for deals or discounts. Cut back on non essential expenses, such as eating out or excessive entertainment costs.

Tip 2: Establish an Emergency Fund:

Work on Building an emergency fund that will cover your unexpected expenses or any disruptions in income. At least you should save 3-6 months’ worth of living expenses. Start small by setting aside a fixed amount each month until you reach your goal.

Tip 3: Review and Reduce Subscriptions:

Assess your recurring subscriptions and memberships. After review, you can cancel unused subscriptions which can save some money. Consider sharing or family plans to split costs with others.

Tip 4: Negotiate Bills and Expenses:

Consider negotiate with service providers, such as internet provider, your OTT services provider for good rates. Review insurance policies and compare quotes from different insurance companies for the same coverage to ensure you’re getting the best coverage for the best price(insurance premium).

Tip 5: Track and Minimize Credit Card Usage:

Keep track of your credit card balances and avoid carrying high balances. Pay your credit card bills in full (total due amount) each month to avoid interest charges. Limit credit card usage to necessary purchases and emergencies only.

Tip 6: Educate Yourself on Personal Finance:

Invest time in learning/reading about personal finance topics, such as how and where to invest money, how to do budgeting, and what are the options saving.

Examples of Good Money Habits

Below examples will help you understand how to have better money management.

Your Credit Score Matters

A good credit score is not only about getting a loan at a better interest rate but having a better credit score actually shows you have good money habits. Many people don’t know about this but they get exposed to credit score, as the approach for any loan they require for their needs.

Having a good credit score is not a difficult thing to do, the only thing you need to do is follow good money habits and pay your outstanding on time.

You can continue to use your credit cards for your regular transactions but do not forget to pay your bills in full on time this will actually help you to build your credit score and get rewarded in the future.

Reduce Credit Card Debt On Priority

Pay yourself first and the next thing on priority should be reducing your credit card debt.

If you are one of the people who is using a credit card for most of your purchases you know you are adding interest and finance charges to your financials.

If not managed well, credit card debt can get out of hand easily for many. So, pay your outstanding credit card bills will be for the due date in full to avoid any finance charges and additional interest.

Repay Your Student Loan On Top Priority

In the process of building better money habits in current times if you have student loans, it is a good idea to focus on repaying your student loan and avoid paying large amounts of interest.

You may get a special bonus if offered by a lender during priority repayment.

Having student loans is nothing to a bad thing, it’s a plan for your future, but take only the necessary amount.

Spend Time on Your Financial Working

Allocate some time during the week to plan your finances, this will make sure that you go as per your plan and do not deviate from it.

On a particular day of the week you can sit and review your financial figures this will give you a chance to work on what needs improvement.

Take account of all your expenses during the week and see where are the opportunities to work on and save money, also consider an emergency fund which you may require in an event.

Keep Track Of Your Living Expenses

We can always start all good things from home and one of them is building better money habits so evaluate your bills and find ways to save money.

Evaluate your utility bills and your monthly subscriptions and see what is really required and what can be cut off.

Always do a little bit of online research for the pricing of your purchase which may give you a chance of saving by avoiding spending extra amount on discounts available.

Learn About Money and Money Management

Always keep learning, this is one of the very good habit one can have. Learning about money will help you two ways one you will understand what you can do better and second you will get closer to your financial goals.

So if you are serious about learning more about money invest your time reading some good articles online, that are relevant to your Financial needs.

Another good thing you can do is buy some good books on money management and start reading them. This will help you building Better Money Habits and doing better money handling.

Invest Smartly

Smart and timely investment can open the doors for financial freedom, but the keys one needs to do it properly. It is advised not to invest in anything unless you have fully understood it hundred percent correctly.

More than anything else you need to understand what are your risk factors which will help you to make a decision regarding your investment to do it or not.

FAQ: What Is Better Money Habits?

How do I create a budget?

Create a budget by tracking your income from all the sources and expenses (Daly needs, planed expenses) categorizing them, and allocating funds to different spending categories, savings, and debt repayment.

Why is saving important?

Saving is crucial for building additional funds like, emergency funds, monthly saving funds, retirement funds.

How can I save money on a tight budget?

Look for areas to cut back on non essential expenses, negotiate bills, compare prices, and practice frugal living by differentiating between wants and needs.

Should I pay off debt or save first?

It depends on your individual circumstances, generally, it’s advisable to focus on high interest debt first, while also setting aside a small amount for savings to prevent emergencies from derailing your progress.

How often should I review my financial progress?

It’s recommended to review your financial progress at least once a month.

Conclusion:

It’s important to remember that building better money habits is not a one time thing but it is an ongoing commitment towards your financial management.

Small, consistent actions taken today (monthly saving money) can yield significant results over time.

So the key lies in being proactive, disciplined, and willing to adapt as your financial circumstances evolve.

Better money habits come with practice/time and the way you control money, rather than the money you earn.

Let me know your thoughts on saving money in comment section below.